译者:格隆汇精译求精翻译组

On the Uber Rollercoaster: Narrative Tweaks, Twists and Turns!

坐在优步“过山车”上:如小说一般的跌宕起伏

A slightly abbreviated version of this post appeared in TechCrunch on October 9, 2015, and it is the first of series of three on the ride sharing business. In the second post, I value Lyft, the other ride sharing company, and also look at how ride sharing companies globally are being priced. In the third and final post, I look at ride sharing as a business and at four possible scenarios for its evolution. Those posts will also appear in TechCrunch over the next two weeks and will be reproduced here soon after.

本篇文章的缩略版本于2015年10月9日被刊登在了Techcrunch上,同时这篇文章也是关于拼车行业的几篇连载中的第一篇。 在第二篇文章里,我对Lyft(另外一家拼车公司)进行了估值,同时也对拼车公司在全球范围内的估值进行了研究分析。在第三篇和最后一篇中,我着重分析了拼车这一商业模式以及在这场拼车革命中可能出现的四种情况。

It seems like ages ago, and perhaps even in a far-off galaxy, that I first valued Uber on my blog, but it was in June of 2014. One reason it seems like a lot of time has elapsed is that Uber has managed to be in the news, for good and bad reasons, almost all through this period. With each news story, the response is either rapturous or funereal, depending on the responder’s prior views on the company. Given how eventful this last year has been, I think it is time for me to revisit my estimates, eat some humble pie and redo my valuation.

我总觉得我第一次在博客里面为优步估值是飘荡在浩渺宇宙的某个遥远星河里的很久远的一件事情了,但看了看日期竟然近在2014年的6月。我之所以觉得时间已经过去了很久是因为优步在这期间不论好坏总是能见诸于报端。每一篇报道下面的评论回复要么欢天喜地,要么如丧考批,具体如何还是要看读者之前对该公司的看法是怎样的了。

A look back

回顾

I became interested in Uber after reading a news story in June 2014 that indicated that it had been valued at $17 billion in a venture capital round. I posted my first valuation of Uber in June 2014, viewing it as an urban car service company, with local (but not global) networking benefits. Assuming that it would increase the size of the urban car service market by about 40%, while preserving its low capital-investment business model, I valued Uber at just under $6 billion.

我是在2014年读完一篇新闻故事后才开始对优步产生兴趣的,新闻里说优步公司在一轮风投里被估值到170亿美金。我早在2014年6月就发布了第一篇优步的估值,文中将优步视为一种市内拼车服务公司,同时会给当地(并非全球性的)其他相关产业带来一定收益。即使优步的出现会使市内拼车服务市场的份额增长40%,但考虑到要维持其低成本投入的商业模式,我当时给优步的估值只有不到60亿美金。

While some in the VC community were quick to dismiss the valuation, I will remain grateful to Bill Gurley for a post where he took me to task for having too narrow a vision of Uber’s business model. In his counter narrative, he argued that Uber was not just urban (it could create inroads in suburbia), not just a car service (it was in logistics & transportation) and that it was working with other businesses to create global networking benefits. Since Bill, as an early investor in Uber with access to its internal workings, clearly knew far more about the company than I did, I revalued Uber using his narrative and arrived at $54 billion as the value that reflected the narrative.

尽管有些风投机构的同僚对我的估值不予理会,但在此我仍然要对比尔格莱表示感谢。他发表了一篇文章,文中批评我对优步的商业模式的评价目光过于短浅。另外,他认为优步并不仅仅是在市内提供服务(因为其服务对象势必会涉及到乡镇居民);同时,它也不仅仅是拼车服务,(还包括了物流和交通运输)由于它与其他产业有所合作,因此也为相关链条产业创造了全球性的收益。作为优步前期的一名投资者,比尔可以了解到公司内部的具体运作,这可比我这个外行了解的多太多了。我之后参考了比尔的论述对优步进行了重新估值,这次我将估值提高到了540亿美金作为对比尔撰文的回应。

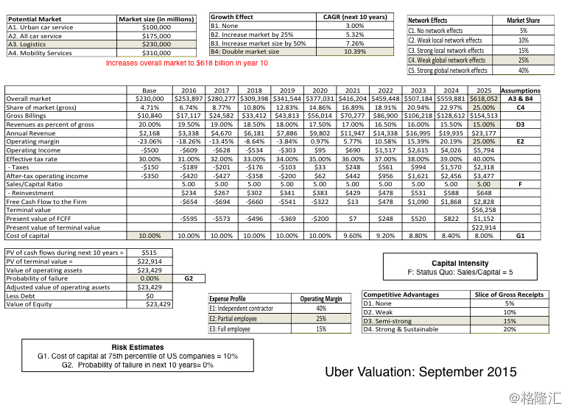

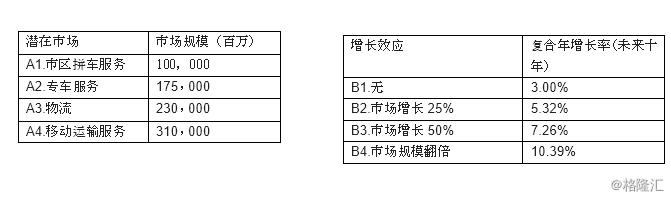

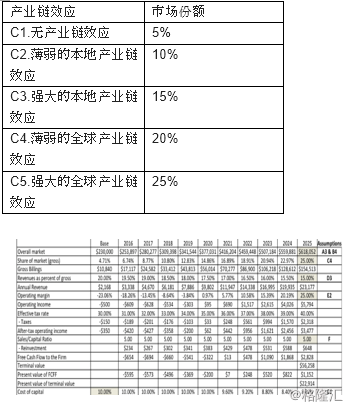

I was then taken to task by value investors who took issue with the value changing so dramatically from my assessment to his, and my response was that this was exactly what you should expect, early in the life of a company, where there is room for widely divergent narratives, and values that reflect these divergences. In December 2014, I tried to show this by creating a build-your-own-Uber valuation template, where I let readers choose Uber’s market (urban car service, all car service, logistics or mobility services), the effect it would have on that market’s size (from none to doubling it), the competitive advantages that would determine its cut of the ride receipts (from the existing 20% down to 5%), the networking benefits it would have (none, local, partial global, global) and business model (from its current no capital intensity to higher capital investments), and derived values for Uber, ranging from less than $1 billion to close to $100 billion.

接着我被一些价值型投资人责备,他们认为我的评估和他们的评估实在是相去甚远,我对此的回应是——这不恰恰就是你们想要的吗?一个公司在初期阶段肯定会出现各种不同的声音和论调,而这些论调正是通过不同的估值反映出来的。在2014年的11月,我做了一个名叫你心中的优步估值的问卷来调查关于优步大家不同的看法,在表格里我让读者们自己选择优步的目标市场(选项有市内拼车服务、专车服务、物流或运输服务)、对这一市场份额的影响(从零到加倍)、其竞争优势可能带来的乘车收入的削减(从现在的20%低至5%)、为其相关的链条产业可能带来的收益(完全没有、当地、全球的部分地区、全球)和商业模式(从其目前的零资本密集度到高资本投入)、以及据此推断出的优步的估值(从少于10亿美元到接近1000亿美元)。

The news keeps coming…

源源不断的新闻

As I noted at the top of this post, it is an understatement to say that Uber has been in the news. Each week brings more Uber stories, with some containing good news for those who believe that the company is on a glide path to a $100 billion IPO, and some containing bad news, which evoke predictions of catastrophe from Uber doubters. For me, the test with each news story is to see how that story affects my narrative for Uber, and by extension, my estimate of its value. In keeping with this perspective, I broke the news stories down based upon narrative parts and valuation inputs.

正如我在本文开头所提到的,优步常常见诸于报端这种说法已经是有所保留的了。每一周优步都会有很多新的报道——例如这个公司正在成为1000亿市值的上市公司的康庄大道上昂首阔步的好消息以及那些对于优步持怀疑态度的人唱衰优步的坏消息。于我而言,检验每一个报道的标准就是看这些报道如何影响我对优步的态度,以及在更宽泛的层面上,如何影响我对优步的估值。为了一直保持这种写作态度,我一般会在叙述层面和价值观输入方面进行剖析。

The Total Market

总体市场

The news on the car service market has been mostly positive, indicating that the market is broader, bigger, growing faster and more global than I thought it was, even a year ago.

总体而言对汽车服务市场的报道大多都是正面的,这也就意味着这个市场比我一年前预测的要更广、更大;增速更大、影响更加全球化。

1. Not just urban and much bigger: While car service remains most popular in the urban areas, it is making inroads into exurbia and suburbia. The evidence for this lies not only in anecdotal evidence and the market capitalizations commanded by ride sharing companies, but also in the numbers that have been leaked by these companies. A presentation to potential investors in the company put Uber’s gross billings for 2015 at $10.84 billion. It is true that these are unofficial and may have some hype built into them, but even if that number over estimates revenues by 20% or 25%, that represents a jump of 400% from 2014 levels.

一.不局限于市区内部,市场更大:尽管拼车服务在城市地区更受欢迎,但它仍然会对城市远郊和近郊地区造成一定的影响。这个结论并不仅仅是根据参股公司的市值和其他道听途说的消息判断出来的,同时也是通过参考这些公司泄露的一些数据所得出的。一份针对该公司的潜在投资者的报告中指出优步在2015年度的毛收入达到了108.4亿美金。尽管这份报告不够官方同时也有放卫星的嫌疑,但是即使这个数据高出实际收入20到25个百分点,那也比2014年度增加了400%。

2. Drawing in new customers: One reason for the increase in the car service market is that it is drawing in customers who would never have taken been in this market in the first place. While the evidence for this is still mostly anecdotal, another leaked report out of Uberindicates that ride sharing has created a market three to four times larger that the original taxi cab/ limo market in San Francisco, the city with the longest history with new ride sharing services. While San Francisco is unusual in terms of the high proportion of its population that is young, tech-savvy and single, the argument that ride sharing is increasing the size of the market elsewhere, though not to the same magnitude that it did in the Bay Area, seems to be a solid one.

二. 不断吸引新的消费者:拼车服务行业市场不断增长的其中一个原因就是它在不断吸引着之前从未进入过的这个市场的新消费者。这一点的根据目前大多仍是道听途说的,但根据从优步泄露出的一份报告来看其在旧金山的市场份额达到了之前出租车市场的三至四倍,而旧金山是拥有最长新型拼车服务产业历史的城市。虽然旧金山的情况比较特殊(其年轻人口、从事高科技产业人口和单身人口比重较大),但不管旧金山和海湾地区的增速是否是一个量级,这个拼车服务产业市场在不断增长事实是毋庸置疑的。

3. With more diverse offerings: The other reason for the jump in the size of the ride sharing market is that it is no longer just a cab service, but instead has expanded to include alternatives that expand choices, reduce costs (car pooling services) or increase flexibility.

三, 提供多元化服务: 拼车服务市场不断增长的另一个原因就是优步不仅仅提供出租车服务,它还为乘客提供了其他扩展服务,减少了乘车成本(例如拼车服务)提高了灵活性。

4. And going global: The biggest stories on ride sharing came out of Asia, as the ride sharing market has exploded in that part of the world, and especially so in India and China. That should really come as no surprise since these countries offers the trifecta for ride sharing opportunities: large urban populations, with limited car ownership and bad mass transit systems.

四. 不断全球化: 最大的拼车服务市场来自亚洲。拼车服务市场在全世界遍地开花,尤其在印度和中国。说实话我们对这一点完全不惊讶,毕竟这些亚洲国家城镇人口巨大同时私家车拥有量有限,交通系统也是一团乱麻,这些都为拼车服务公司提供了机遇和市场。

The bad news on the car service market front has come mostly in the form of taxi driver strikers, regulatory bans and operating restrictions. Sao Paulo may be the latest city to restrict Uber, but it is part of a long list of cities or entire countries that have tried to ban or restrict ride sharing. Even that bad news, though, contains seeds of good news, since the status quo would not be trying so hard to stop the upstarts, if ride sharing was not working. In my view, the attempts by taxi operators, regulators and politicians to stop the ride sharing services reek of desperation, and the markets seem to reflect that. Not only have the revenues collected by taxi cabs in New York city dropped significantly in the last year, but so has the price of NYC cab medallions, dropping almost 40% in value (roughly $5 billion in the aggregate) in the last two years. While auto sales may not have been affected materially yet, there are worries that there will be a drop in sales in future years, as people replace a "second" car or even a "first" car with ride sharing services.

来自拼车服务市场方面的坏消息大部分都来自出租车司机罢工论坛、管控禁令和运行限令。圣保罗可能是最新一个禁止优步的城市,但它仅仅是很多试图禁止或限制拼车服务的城市或国家之一。尽管有坏消息,但是我们还是能看到希望——要是拼车服务真的不可行的话,它的现状就不会是像现在这样并没有被当局想尽一切办法掐断在萌芽状态。在我看来,出租车司机、监管者和政客想要全面禁止拼车服务的尝试已经穷途末路了,同时,市场的反应也佐证了这个观点。去年不仅纽约的出租车收入狂跌,连纽约出租车牌照的价格也在去年两年内贬值了40%(总价大约是50亿美元)。尽管汽车销量并没有收到什么实质性的影响,但是有人担心在未来几年内汽车销量会下跌,因为很多人已经将拼车服务视为第二出行方式,甚至代替了自己的私家车成为首选的出行方式。

In my December post, I noted the possibility that Uber could move into other businesses. The good news is that it has delivered on this promise, offering logistics services in Hong Kong and New York, and food delivery service in Los Angeles. The bad news is that it has been slow going, partly because these are smaller businesses (than ride sharing) and partly because the competition is more organized. However, these new businesses have moved from just being possible to plausible, thus expanding the total market.

在我12月发表的文章中,我提到优步可能会转移到其他产业。好消息是我的预测确实应验了,优步在香港和纽约提供了物流服务,在洛杉矶提供了食物运输服务;坏消息是这些业务进展缓慢,有一部分的原因是因为比起个人拼车服务,上面提到的这些其他业务的市场实在是小的可怜。另一部分原因是因为这些产业的竞争更加有组织性。尽管如此,这些新兴业务还是从仅仅有可能出现发展到现在缓慢发展的状态,从而扩展了整体市场。

Bottom line: The total market for Uber is bigger than the urban car service market that I visualized in June 2014, and will attract new customers, and expand in new markets (with Asia becoming the focus), and perhaps even in new businesses.

概要: 优步的完整市场比起我在2014年6月所预测的市内拼车服务市场要大得多,并且也会不断吸引新消费者,还会扩展新市场(主要针对亚洲市场),还有可能开拓新的业务领域。

Networking & Competitive Advantage (Market Share and revenue sharing)

产业链&竞争优势(市场份额和收益共享)

The news on this front is more mixed. The good news is that the ride sharing companies have increased the cost of entry into the market, with tactics such as paying large amounts to drivers as sweeteners to sign up. In the US, Uber and Lyft have become the biggest players, and some of the competitors from last year have either faded away or been unable to keep up with these two. Outside the US, the good news for Uber is that it is not only in the mix almost everywhere in the world but that Lyft has, at least for the moment, decided to stay focused on the United Statesin its expansion choices.

关于这方面的新闻就更多元了。好消息是拼车服务公司提高了抢占新市场的成本,例如为了鼓励司机们注册公司会支付他们更多补贴。在美国,优步和Lyft已经成为了拼车服务市场的两大巨头,去年以来其他竞争者要么消失的无影无踪要么就与这两大巨头的市场份额相去甚远。在美国之外,不仅全球其他地区都像美国本土这样各种公司鱼龙混杂,而且目前Lyft在是否扩张这个问题上的决策是只专注做美国本土市场,这对优步来说无疑是个好消息。

The bad news for Uber is that, especially in Asia, the competition has been intense, and that it is fighting against domestic ride sharing companies that dominate these markets, Ola in India, Didi Kuaidi in China and Grabtaxi in South East Asia. Some of the domestic company dominance can be attributed to these companies being first movers and understanding local markets better, but some of it also reflects that the market is tilted (by local investors, regulation and politics) towards local players. There is even talk, though it may be just that, that these competitors will band together to create a “not-Uber” network that can share resources and users, though the news story, two weeks ago, that Didi Kuaidi and Lyft were going to create a formal partnership adds heft to the thesis. To add to the mix, all of these ride sharing companies have been able to access capital at sky-high valuations, reducing the significant cash advantage that Uber had earlier in the process.

坏消息是,拼车服务市场的竞争变得异常激烈,尤其是在亚洲,优步正在与当地市场的巨头打着一场恶仗,例如印度的Ola,中国的滴滴和快滴,东南亚地区的Grabtaxi等。当地拼车服务公司之所以能成为市场巨头很大程度上是因为他们先人一步攻占了市场并且对于当地市场更加了解,但在某种程度上也反映了这个市场被当地投资者、监管者和政客打上了本土产业的标签。有消息称这些本土的竞争者们会联合在一起打造一个“非优步”产业链来共享资源和客户。两周以前的一篇报道称滴滴快滴和Lyft已经建立了正式合作伙伴关系,这也说明上文并非空穴来风。为了使市场更加多元化,所有这些拼车服务公司需要更加高昂的估值资本以减少优步之前进行现金补偿所带来的影响。

No matter how this process plays out, one of the key numbers that will be (and in some cases is already) under pressure, due to this more intense competition, is the sharing of the gross billing, currently set at 80% for the driver and 20% for the ride sharing business. In many US cities, where Lyft is challenging Uber most aggressively, Lyft is already offering drivers the opportunity to keep all of their earnings, if they drive more than 40 hours a week. While the threat of mutually assured destruction has kept both companies from directly challenging the 80/20 sharing rule, it is only a matter of time before that changes.

不论这个过程将如何结束,在愈发激烈的竞争中,其中一个重要的数据将会发生变化(在某些案例中已经变了),这就是——毛收入的份额,目前分红的比重是司机80%,租车服务公司20%。在美国的很多Lyft和优步竞争激烈的城市,Lyft承诺司机有机会保留所有收入,前提是他们一周工作时间超过40个小时。这种做法虽同时避免了他们直接挑战80/20的分红规则,但按照这种鱼死网破的手段来看,改变分红规则也是迟早的事。

Bottom line: The ride sharing market is becoming competitive, but as costs of entry rise and the capital requirements become intense, it looks like this will be a market with fewer players with larger regional networking benefits and more capital.

概要:拼车服务市场的竞争逐渐白热化,但鉴于抢占市场的成本增加和资本密集度要求的提高,这个市场里的玩家会越来越少而区域相关链条产业的收益和资本会越来越多。

Cost structure

成本结构

This is the area where the most bad news has been delivered. Some of the pain has been from within the ride sharing business, as companies have taken to offering larger and larger up-front payments to drivers to get them to switch from competitors, pushing up this component of costs. Much of the cost pressure, though, has come from outside:

坏消息往往都来自于这个领域。一些压力来自于拼车服务公司内部,因为这些公司为了从竞争对手处挖更多的司机,他们承诺可以预付司机报酬,这就提高了一部分成本。然而大多数的成本压力还是来自于外部:

1. Drivers as partial employees: Early in the summer, the California Labor Commission decided that Uber drivers were employees of the company, not independent contractors. That ruling was further affirmed by a court decision that Uber drivers could sue the company in a class action suit, and it is likely that there will be other jurisdictions where this fight will continue. While ride sharing companies may be able to delay the effect, it is almost inevitable that at the end of the process, drivers for ride sharing companies will be treated perhaps not as employees but as semi-employees, entitled to some (if not all) of the benefits of employees (leading to higher costs for ride sharing companies).

一. 司机作为半员工: 今年初夏的时候,加州劳动委员会决定将优步司机归属于该公司的员工行列,不再是独立的自由职业者。这项规定又进一步经过了法庭的决策认证——优步司机可以通过集体诉讼来起诉公司,同时似乎有可能这场关于权利的拉锯战会继续下去。然而拼车服务公司可能会推迟生效该项决策,因为在整个过程的后期阶段,司机们虽不可能成为全职员工但不可避免的会被当做半员工对待,同时享受全职员工的一些福利(这样就导致了公司要支出更加高昂的成本)。

2. The insurance blind spot will be filled: The other shoe that is poised to drop is the cost of car insurance. Ride sharing companies in their nascent years have been able to exploit the holes in auto insurance contracting, often just having to add supplemental insurance to the insurance that drivers already have. As both regulators/legislators and insurance companies try to fix this gap, it is very likely that drivers for ride sharing companies will soon have to buy more expensive insurance and that ride sharing companies will have to bear a portion of that cost.

二. 填补保险方面的漏洞:另一个悬在这些公司头上的达摩克利斯之剑就是车险方面的花销。拼车服务公司在成立初期阶段往往只需要在司机原有车险的基础上增加一些补充险,将保险合同的坑越挖越大。时至今日监管者/立法者和保险公司也意识到了这个问题,决定采取措施来填补这个漏洞。以后拼车服务公司的司机很可能要投保费更加高昂的保险,而公司则要承担一部分保费。

3. Fighting the empire is not cheap: Earlier in this post, I noted that the status quo (the taxi business and its regulators) was fighting back and that its cause was hopeless. However, the fight will still be expensive as the amount of money spent on lobbying and legal fees will increase, as new fronts open up.

三. 与出租车行业帝国叫板需要巨大开支:上文中提到现在出租车行业和该行业的监管者已经开始反击。虽然出租车行业胜利的希望渺茫,但这场仗势必要在游说各方和法律诉讼费用方面产生巨大的新开支。

The evidence that costs are running far ahead of revenues again comes from leaked documents from the ride sharing companies. This one, for instance, shows that Uber was a money loser last year and in this one, the contribution margins (the profits after covering just variable costs) by city not only reveal big differences across cities, but are uniformly low (ranging from a high of 11.1% in Stockholm and Johannesburg to 3.5% in Seattle).

根据一份从拼车服务公司内部泄露的文件来看,目前这些公司成本花销远远高于其收入。例如,该报告指出去年优步公司处于亏损的状态,各城市之间的贡献毛利(除去可变成本后的利润)虽然有很大差异,但出奇一致的则是这些城市的贡献毛利都极低(最高的是斯德哥尔摩和约翰内斯堡的11.1%,最低的则是西雅图的3.5%)

Bottom line: The costs of running a ride sharing business are high, and while some of these costs will drop, as business scales up, the operating margins are likely to be smaller than I anticipated just over a year ago.

概要:经营一家拼车服务公司的成本是十分高昂的,即使在某些方面能够节省一些成本,但随着企业规模的扩大,其营业毛利还是可能会比我一年前预测的要微薄少许。

Capital Intensity and Risk

资本密集度和风险

The business model that I assumed when I first valued Uber was minimalist in its capital investment requirements, since Uber not only does not own the cars driven by its drivers but invests little in corporate offices or infrastructure. That translated into a high capital turnover ratio, with a dollar in capital generating five dollars in additional revenues. While that basic business model has not changed, ride sharing companies are recognizing one of the downsides of this low capital intensity model is that it has increased competition on other fronts. Thus, the high costs that Uber and Lyft are paying to sign up drivers can be viewed as a consequence of the business models that they have adopted, where drivers are free agents who are not bound to either company.

当我第一次为优步估值的时候,我推断其商业模式是采取投资资本需求量的最低水平,因为优步的资产除了司机用到的汽车之外还有少许公司办公室及其他一些基础设施。这样换算成资本周转率就是一美元资本可以产生五美元的额外进账。然而这种基础商业模式不改变的话,拼车服务公司就要好好考虑一下这种低资本密集度模式带来的弊端了,也就是说他们必须要在其他方面提高竞争力。

For the moment, there is no sign that any of the ride sharing companies is interested in altering the dynamics of this model, by either upping its investment in infrastructure or in the cars themselves, but this news story about Uber hiring away the robotics faculty at Carnegie Mellon may be suggestive of change to come.

目前来看,不管是提高基础设施方面的投入还是汽车本身方面的投入,还没有一家拼车服务公司表现出想要通过这种方式来改变该运行模式的意思,不过有报道称优步从卡内基梅隆大学挖到了机器人工程专业的人才,这可能意味着拼车服务业的变化要来了。

Bottom line: Ride sharing companies will continue with the low capital intensity model, for the moment, but the search for a competitive edge may result in a more capital intense model, requiring more investment to deliver sustainable growth.

概要:目前来看,拼车服务公司未来可能会继续这种低成本密集度的商业模式,但是要想更有竞争优势就要去寻求一种成本更加密集的商业模式,投入更多资金来维持稳定的发展。

Management culture

管理文化

Though not a direct input into valuation, it is unquestionable that when investing in a young business, you should be aware of the management culture in that business. With Uber, your responses to the news stories about its management team will reflect your priors on the company. If you are predisposed to like the company, you will view it as confident in its attacks on new markets, aggressive in defending its turf, and creative in its counter-attacks. If you don’t like the company, the very same actions will be viewed as indicative of the arrogance of the company, its challenging a status quo will signal its unwillingness to play by the rules and its counter attacks will be viewed as overkill.

尽管这一项不在估值的直接考虑范围内,但毫无疑问当你投资一个刚起步的公司的时候你一定会考虑考虑这个公司的管理文化。就优步而言,你对新闻中出现的有关其管理团队的内容的反馈会反映出对这间公司你首先考虑的会是哪些问题。比如说如果你倾向于看好这间公司,你会把抢占新市场看作是他们的信心,把保护领地看作是他们的进取心,把防守反击看作是他们的创造力。但如果你不喜欢这件公司,同样的行为就会被你看作是傲慢野蛮狂妄自大,任何对于现状的改变都会被你当成不按套路出牌,而防守反击就成了为了一家独大的赶尽杀绝。

In New York, I saw this come into play when the mayor and city council decided to restrict the ride sharing companies (and Uber in particular) from expanding in the city, using the argument that it was worsening traffic conditions in the city. In response, Uber struck back with a counter publicity blitz which included not only radio and TV ads, but also add-ons to the Uber app that left no doubt in Uber users’ minds about how these restrictions would affect their choices. I thought that the DeBlasio option on the Uber app was clever, and while Uber won this battle with New York city, I wonder whether the scorched earth policies that it used will come back to hurt the company down the road.

在纽约,我目睹了管理文化是如何起作用的,当时纽约市长和议会决定限制拼车服务公司(尤其是优步公司)在城市的扩张,理由是它加剧了城市的交通问题。优步通过广告宣传闪电战进行了反击,不仅在电台和电视频道循环播放广告宣传,还通过优步的应用软件推送来告诉用户们这项限令会对他们的个人选择产生多大的影响。我觉得De Blasio在优步应用软件的这项选择上是十分明智的,同时,虽然优步在纽约打了一场胜仗,但这样的焦土政策是否会把公司引向末路还是个未知数。

Bottom line: While there are a few indications that Uber might be trying to soften its image, there seems no reason to believe that the company will become less aggressive in the future. The question of whether this will hurt them as they scale up remains unresolved.

概要:尽管有些许迹象表明优步在努力软化自己的企业形象,但这并不代表未来优步会在决策上更加温和。随着企业规模的扩大这个问题会不会损害企业利益还有待观察。

Uber: An Updated Valuation

优步:最新估值

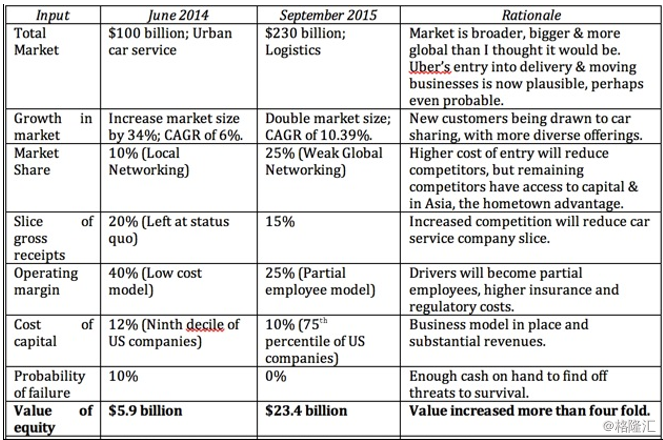

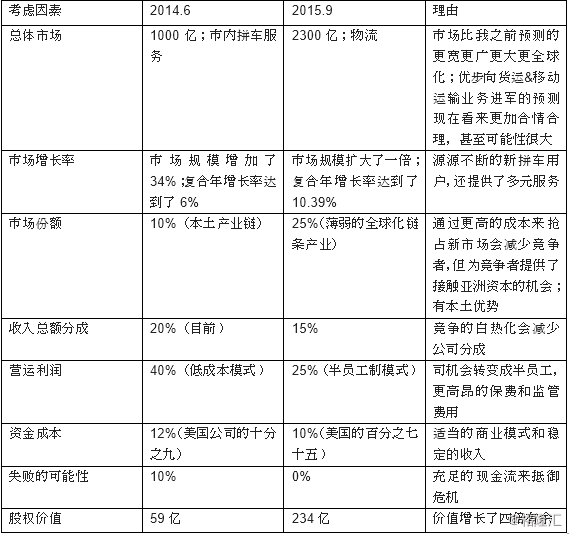

In summary, a great deal has changed since June 2014, partly because of real changes that have happened to the ride sharing market since then and partly because I had to fill in gaps in my ignorance about the market. I think that the best way to capture the shifts in my valuation is to compare my inputs on key numbers in June 2014 with my estimates in September 2015.

总体而言,从2014六月开始价值发生了很大变化,一部分是因为拼车服务市场在那之后发生了变化,还有一部分是因为我要弥补我当时疏忽了市场这方面考虑的错误。我认为要直接观察我在估值上面的变化的最佳方式就是比较我在2014年6月和在2015年9月给出的数据。

I was wrong about Uber’s value in June 2014, when my estimate of $6 billion was below the $17 billion assessment by venture capitalists then. Correcting for both my cramped vision and the changes that have occurred since June 2014, my estimated value today is $23.4 billion.

当风投机构的同僚给出170亿的资产估值,而我在2014年6月只给出了60亿我就知道我错了。为了弥补之前因为目光短浅而犯下的错误同时也重新考虑了自2014年6月以来发生的各种变化,现在我对优步的估值是234亿美金。

I know my estimated value lags the $51 billion value that VCs are attaching to the company today. This may very well be a reflection that my vision is still too cramped to capture Uber’s possible businesses, but it is what it is.

我知道我的预测估值仍旧比风投公司附加给优步公司的价值低了整整510亿;这可能又反映出我对待优步的商业模式的目光依旧不够远大,但事实就是如此。

Fire away

补充

When teaching and writing, my objective is to evoke interest and excite my audience, and failing that, to provoke dissent and incite argument, but the reaction that I dread the most is boredom. The very fact that you are reading this post still is good news, but if you are in complete agreement with my valuation of Uber, I have failed. I would rather that you fall into one of three groups: that you think my value is too high, that you feel it is too low or that you believe that I have no business even valuing Uber.

每当我教学或者写作的时候,我的目的就是激发听众的兴趣,如果不成功的话,那听众势必会有异议并引起讨论,但是我最怕得到的反馈就是无趣。实际上,这篇文章你已经看到这里了对我来说是个好消息,但是如果你完全不同意我对优步的估值,那么我也算是一个失败的作者了。我宁愿你属于下面这三类:1.你觉得估值过高;2.你觉得估值过低;3.你觉得我根本无权队友不进行估值

If you think I have over estimated the value of Uber, it should not be because it is losing money (given its growth trajectory, you should be suspicious if it did not), is trading at a high multiple of revenues (it should) or because your stable growth dividend discount model gives you too low a number (it is the wrong tool for a growth company). It should because you think the regulatory roadblocks will make the ride sharing market smaller than I have forecast it to be, and that competition will be much more intense (reducing market share and operating margins).

如果你认为我对优步的估值过高,那么你该放弃这个观点了,因为优步确实是在赔钱(考虑到该公司的增长轨迹,如果不亏本的话那才值得怀疑呢),还因为优步在多方面都做到了创收(这是应该的)或者还因为你的稳定增长股利贴现的思考模式导致你给出了一个过低的数据(这个工具对于一个正在成长的企业来说可是行不通的)。也有可能你认为那些监管障碍会使拼车服务业的规模缩水,竞争也会更加的白热化(减少了市场份额和运营利润)

If you think that I have under estimated the value of Uber (again), don’t blame DCF models for being biased against growth companies. The fault lies with me, and it has to be somewhere in my inputs, i.e., that I am not foreseeing other markets that Uber could enter, that its networking benefits are far stronger globally than I predict them to be (giving it a higher market share) or that the operating margins will bounce back to much healthier levels once they navigate their way through the growth phase.

如果你认为我(又)低估了优步的价值,那就不能怪DCF模式对成长中的企业有所偏见啦。错误毕竟是我犯的,而且肯定会在我的数据中体现出来,也就是说,我没有预见到优步可能抢占的其他市场,同时其产业链也比我之前预测的更加全球化(假设他们有更大的市场份额)或者当优步精准定位了他们的成长模式其营运利润可能会反弹回至一个更加健康的水平上。

If your view is that I have no business valuing Uber because I am not a tech person, that I am not an expert in the ride sharing business and/or that I have not made money as a VC, my responses are guilty as charged, you are right and without a doubt. I don’t have a tech background, don’t work on the right coast and know technology only as a user, but I don’t think any of those are prerequisites for investing in technology companies. I have tried to incorporate what I have learned from technology companies in the market into the valuation, in the form of easier scaling up, larger networking benefits and bigger market effects, but I might not have done it well enough. There are many who know a great deal more about ride sharing than I do, and while I have tried to learn about the inner workings of this business from Harry Campbell and about the Chinese growth potential from Drake Ballew, my ride sharing know-how is limited. Finally, if we did restrict writing about the valuation of young companies only to venture capitalists who have been consistently successful over long periods, the list of potential writers would be very short, and most of the people on the list would be too busy investing in these startups to write about them.

如果鉴于我非高精尖人才的身份且在拼车服务领域也并非专家,同时在风投机构也没有赚大钱所以你认为我根本无权为优步估值的话,那么毋庸置疑你是正确的,我承认我的罪名成立。我确实并没有科技背景,也没有在东海岸工作过,我了解到的东西跟一个普通的用户相差无几,但是我认为这些都不是投资科技公司的必要前提。我尽力将我在投资科技公司中学到的东西与估值相结合,例如使规模扩张形式更加简易,使产业链利润更可观以及使市场效应跟有影响力,但是我可能做的还远远不够。有很多比我专业的多的人,例如Harry Campbell,一个该行业的内部从业者,我正在向他学习拼车服务业的内部知识,另外,我也跟Drake Ballew了解了中国市场的增长潜力,毕竟我对本行业营运的具体操作知之甚少。最后,如果我们只为风投从业者写那些能在长期内取得成功的公司的估值的话,那么作者的名单可能要减少一大半,同时剩下的那批人就会忙着去投资那些公司赚钱而不去写作了。

Whatever group you belong to, rather than complain about my mistakes (which are too many to count) or bemoan my limitations (which are legion), please take my Uber valuation and make it yours, putting your superior knowledge and experience into the numbers. In fact, let’s give this a crowd valuation twist and get a shared Google spreadsheet going, where you can post your results.

不管你是哪一类人,与其抱怨我的错误(错误有点太多了)或者为我的局限性(也不少)叹息,那就看看我做的那个你心中的优步估值的表格然后运用你专业的知识和经验自己去做一份估值吧。实际上,我们可以一起来做一个集体估值然后将自己的结论贴到Google的电子数据表。

To be continued..

未完待续

Notwithstanding the dressing down that I got from some in the technology/VC space for my first valuation of Uber, or perhaps because of it, there is no company that I have enjoyed valuing and talking about more during the last year, than Uber. The company illustrates all the broad themes in valuation that I have returned in my blog posts and teaching: that uncertainty is part and parcel of valuation, that narratives drive numbers and that the pricing and valuation processes can yield different numbers. As a teacher, I am constantly on the look out for learning and teaching moments, and few companies have offered me more than Uber.

尽管有批评说我给优步的第一份估值是受了专业人士/风投业者的影响,或者确实有这个原因吧,去年我考虑的最多同时也谈论的最多的公司也只有优步了。优步公司解释了所有我在博客中刊登的和科普的有关估值的主题:跟着估值随之而来的就是不确定性,那些极具戏剧性的数字和估值的过程都可能产生不同的数据。作为一个老师,在传道授业解惑的同时我也在不断学习这,我在优步身上是学到最多的。

To show you how much Uber has found its way into my every day thinking, I will end with a personal story. Towards the end of last summer, my youngest son, who is fifteen had a friend over for the afternoon, and when it was time for the friend to leave, I looked out at the driveway, expecting the “Mom car", the typical mode of transportation for a 15-year old in the middle of suburbia (where I live). When I saw a strange sedan with a bearded man in the driver’s seat, I was taken aback, until I was told that it was an Uber car. Since this happened only two months after my valuation of Uber in June 2014, where I labeled it an urban car service company, my first reaction after I got over my surprise was that I needed to revalue Uber afresh. Of such small actions are obsessions born!

我每天都在考虑怎样给你们展示优步的发展模式,接下来我就以一个自己的小故事来结尾吧。去年夏天快结束的时候,我十五岁的小儿子有个朋友有一天下午过来我家玩,他该走的时候我看了看外面的马路想找一辆“妈妈车”(我住在郊区,这种车对一个15岁的孩子来说最合适不过了)给他。当我看到一个大胡子男开着一辆完全陌生的车过来的时候,我还有点害怕,但听了他是优步派来的司机之后我就放心了。因为这件事就发生在我2014年6月给优步估值的两个月之后,我还给优步的车打上了市内拼车服务的标签呢,惊喜之余我的第一反应就是我真该给优步重新估值。这些类似的小反应也真是让我困扰了很久呢!

欢迎登陆『格隆汇』官网www.gelonghui.com

或下载『格隆汇』APP,获取更多精彩资讯,与作者直接交流!

4000520066 欢迎批评指正

All Rights Reserved 新浪公司 版权所有